Filter by

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money--That the Poor …

Rich Dad Poor Dad is Robert's story of growing up with two dads — his real father and the father of his best friend, his rich dad — and the ways in which both men shaped his thoughts about money and investing. The book explodes the myth that you need to earn a high income to be rich and explains the difference between working for money and having your money work for you.

- Edition

- -

- ISBN/ISSN

- 9781612681139

- Collation

- 350 pages.: illus.; 16 cm.

- Series Title

- -

- Call Number

- 332.024 KIY r

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness

Doing well with money isn't necessarily about what you know. It's about how you behave. And behavior is hard to teach, even to really smart people. Money--investing, personal finance, and business decisions--is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don't make financial decisions on a spreadsheet. They make them a…

- Edition

- -

- ISBN/ISSN

- 9780857197689

- Collation

- -

- Series Title

- -

- Call Number

- 332.401 HOU p

Why the Rich Are Getting Richer: What Is Financial Education ... Really?

- Edition

- -

- ISBN/ISSN

- 9781612680972

- Collation

- 340 pages.: illus.; 16 cm

- Series Title

- -

- Call Number

- 332.024 KIY w

- Edition

- -

- ISBN/ISSN

- 9781612680972

- Collation

- 340 pages.: illus.; 16 cm

- Series Title

- -

- Call Number

- 332.024 KIY w

The Business of the 21st Century

Explains the revolutionary business of network marketing in context of what makes any business a success in any economic situation. This book lends credibility to multilevel marketing business, and justifies why it is an ideal avenue to make money

- Edition

- Cetakan ke-9

- ISBN/ISSN

- 9786060367835

- Collation

- 15 x 23; Pbk; bw; 168p

- Series Title

- -

- Call Number

- 658.11 KIY b

Piggybanking: Preparing Your Financial Life for Kids and Your Kids for a Fina…

Piggybanking is a must-have financial guide that shows couples how to afford kids and how to teach them about money. A longtime personal finance writer for the Wall Street Journal, author Jeff D. Opdyke offers invaluable advice for young families no matter what the financial climate—recession or boom—in a one-of-a-kind handbook for “Preparing Your Financial Life for Kids and Your Kids for…

- Edition

- 1st Edition

- ISBN/ISSN

- 9780061358197

- Collation

- xvi+223p; pbk; bw; 135x203 mm

- Series Title

- The Wall Street Journal

- Call Number

- 332.024 OPD p

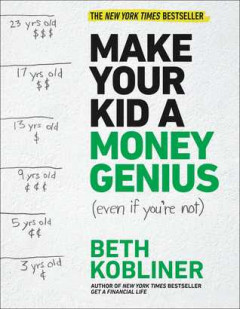

Make Your Kid A Money Genius (Even If You're Not)

The New York Times bestseller that is a must-read for any parent! From Beth Kobliner, the author of the bestselling personal finance bible Get a Financial Life—a new, must-have guide showing parents how to teach their children (from toddlers to young adults) to manage money in a smart way. Many of us think we can have the “money talk” when our kids are old enough to get it…which w…

- Edition

- 1st Hardcover Edition

- ISBN/ISSN

- 9781476766812

- Collation

- x+258p; hc; bw; 18.5x24 cm

- Series Title

- -

- Call Number

- 332.024 KOB m

Computer Science, Information & General Works

Computer Science, Information & General Works  Philosophy & Psychology

Philosophy & Psychology  Religion

Religion  Social Sciences

Social Sciences  Language

Language  Pure Science

Pure Science  Applied Sciences

Applied Sciences  Art & Recreation

Art & Recreation  Literature

Literature  History & Geography

History & Geography